Protective Put / Cash Secured Put

The Protective Put Setup

Let’s say you own 100 shares of a renewable energy company called GreenTech, trading at $50 per share. You think this might be quite volatile in the near term, but long-term prospects are good. Therefore, you buy a put with a strike price of $45 that expires in three months. To buy this put, you will need to pay a premium of $3 per share.

Who Should Consider It

This strategy is especially well-suited for those who have a bullish outlook on the long-term prospects of their stock but are worried about short-term dips. It can also apply to those wanting to protect unrealized gains without selling their shares.

Strategy Explained

By purchasing this put option, you acquire the right to sell your shares at the strike price, irrespective of how much the stock price plummets. This offers a safety net so you could cap your losses if the stock price moves significantly down.

Breakeven Process

To find the breakeven point on a protective put, simply add the premium paid to your original cost basis in the stock. If your cost basis was $50 per share and you have paid a put premium of $3, your breakeven price is $53 per share.

Sweet Spot

This sweet spot occurs when the price of the stock is well above the breakeven point at expiration. This enables you to enjoy the advantage without the downside risk of any major collapse.

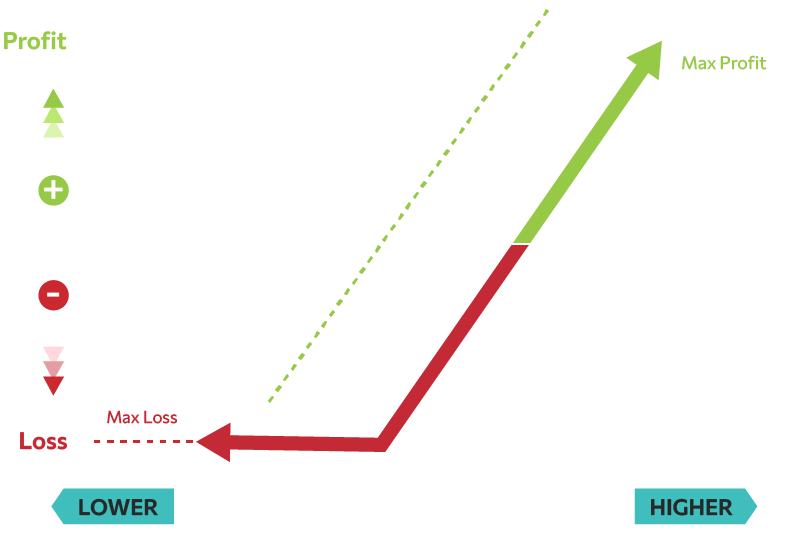

Max Profit Potential

The theoretically unlimited potential profits-the maximum profits, since the stock can theoretically increase without limit. The profits from the sale of the stock are offset by the premium paid for the put, only up to the break-even; anything after that is pure profit.

Maximum Loss

You can only lose the sum of the premium of the put and the price difference between the money you spent to buy the stocks and the put strike price if the stock has gone to zero. In our GreenTech example, had the stock gone bankrupt and became worthless, your total losses come from the difference of the stock price ($50) and the strike price ($45) plus the option premium paid ($3): $8 a share.

Risk

The risk is carried by the cost paid for the put. Given that really volatile stocks can get very high, buying puts can carry their own risks. Also, the put option only starts to become a liability once the stock price is stable or is on the slight down, into which the involvement of cost of premiums, and automatically decrease the total return on your investment.

Time Decay

Time decay is critical since it removes some of the money paid for the put option, assuming the stock price remains above the put strike price, closer to the expiration date. This means the protective put will become less effective in acting as a short-term protection unless it is adjusted regularly.

Implied Volatility

A high level of implied volatility increases the value of the put option, due to the expected risk for big price movement of the underlying security that is reflective in the premium of your put option. On the flip side, if the volatility diminishes, put protection becomes less expensive to purchase, but the downside is that the put you have bought is now worth less.

Conclusion

The put is a valuable strategy for investors who wish to hedge potential downward risk while allowing for some upside. It is most useful in muddled markets or when holding volatile stocks. The biggest downside is the cost of puts; if the feared drop does not happen, this can detract from the investment gain.