SensaMarket Blog - Market Insights & Trading Strategies

Navigating Markets, One Blog at a Time

Jan-09-2026

How to Read and Interpret Unusual Options Flow Like A Pro

Learn how to read unusual options flow, avoid common misreads, and use flow data with calculators and logic, not blind assumptions.

Jan-07-2026

Options Trading 101: What Every New Investor Should Know Before Getting Started

New to options trading? Learn how options work, common risks, and what to understand before choosing an options trading platform.

Jan-06-2026

How Institutional & Insider Trading Activity Can Impact Retail Moves: A Guide to Interpreting Data

Institutional and insider trading activity often influences market moves. Learn how retail traders can interpret this data responsibly.

Dec-30-2025

Why Retail Traders Are Turning to Options – The Rise of Smart Money Tracking Tools

Retail traders are increasingly using options tools to track smart money, assess risk, and calculate profit scenarios before entering trades.

Dec-10-2025

How Data Driven Options Trading Platforms Transform Strategy Building

Explore how data driven options trading tools enhance strategy building with real time insights, analytics, simulators, and institutional activity tracking.

Dec-05-2025

Implied Volatility Decoded: The Key to Timing Options Entries and Exits

Learn how implied volatility helps time options entries and exits with better accuracy. Understand IV rank, IV percentile, and strategy timing for smarter trades.

Dec-02-2025

7 Proven Stock Option Trading Strategies for Smarter, Data-Driven Trading

Discover seven proven stock option trading strategies designed for smarter, data-driven decision-making. Learn how to trade with confidence using real insights.

Nov-28-2025

Tracking Institutional, Insider, and Politician Trades Using SensaMarket Data

Learn how SensaMarket helps track institutional, insider, and politician trades in real time to improve trading decisions and build stronger strategies.

Nov-06-2025

AI-Powered Trading: How Smart Algorithms Can Improve Your Options Strategy

Discover how AI-driven trading platforms transform options trading. Use smart algorithms, unusual options for flow trackers, and predictive analytics to make informed decisions, manage risk, and boost potential returns.

Nov-03-2025

Unusual Options Flow Explained: Spotting Big Money Moves Before They Happen

Learn how to spot Unusual Options Flow to track institutional trades before they impact the market. Use flow data, AI tools, and options for calculators to enhance your strategy and make smarter trading decisions.

Oct-27-2025

Step-by-Step: Building Advanced Options Strategies on Sensa Market

Build and test advanced options strategies on SensaMarket using visual tools, spread calculators, paper trading, and real-time alerts.

Oct-10-2025

How to Use Order Flow for Smarter Futures Trading with SensaMarket

Discover how order flow, flow algos, and unusual options flow with SensaMarket help traders gain real-time insights, improve timing, and trade futures smarter.

Oct-08-2025

Iron Condors, Straddles, and More: Mastering Options Strategies with SensaMarket

Learn straddles, strangles, iron condors & iron butterflies with SensaMarket’s advanced tools. Trade smarter in any market with confidence.

Oct-05-2025

AI in Options Trading: How SensaMarket Helps You Trade Smarter

Discover how SensaMarket uses AI to simplify options trading with smart tools, real-time insights, and strategies for both beginners and experts.

Sep-30-2025

Options Greeks Made Simple: Using Delta, Gamma, Vega, and Theta on SensaMarket

Learn Delta, Gamma, Vega & Theta with SensaMarket to calculate profit, manage risk, and trade options smarter and faster.

Sep-21-2025

Inside the Tools: A Deep Dive into SensaMarket’s Insights

Discover how SensaMarket empowers traders with 100+ pre-built strategies, real-time market data, and live insights. Perfect for both beginners and experts looking to trade smarter.

Sep-12-2025

How to Use Implied Volatility Simulations to Improve Options Trades?

Leverage implied volatility simulations to analyze market trends and optimize your options trades for smarter, more informed decisions. To know visit Sensamarket

Sep-08-2025

Decoding Unusual Options Activity and What It Means for Traders

Learn how to spot and interpret unusual options activity to uncover market trends, detect “smart money” moves, and make more informed trading decisions.

Sep-02-2025

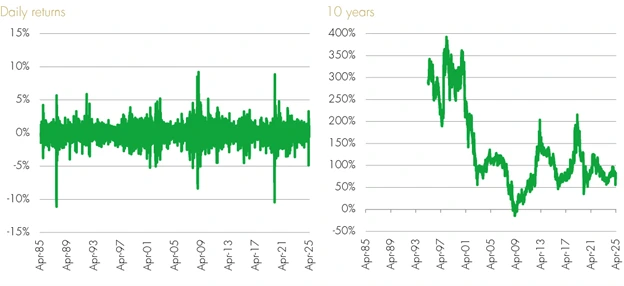

Historical Price Charts: How Past Data Can Shape Future Trades

Discover how analyzing historical price charts helps traders spot trends, test strategies, and make smarter decisions for more successful future trades.

Aug-11-2025

Top Trading Applications in 2025: Features Retail Traders Can’t Afford to Miss

Explore the best trading apps of 2025 built for smarter, faster trades. Discover features retail investors need—advanced charting,real-time data, secure access, and more.

Aug-06-2025

Build & Backtest: How Simulators Help Institutional Traders Refine Strategies

Use a trading simulator to learn options trading, test stock strategies, and apply institutional data—practice risk-free like the pros. To know more visit our website.

Aug-04-2025

From Warren Buffett to Berkshire Hathaway: Trading Strategies for Retail Investors in 2025

Learn how Warren Buffett’s 2025 trading strategies help retail investors make smart, long-term decisions in a fast-changing, tech-driven market.

Aug-01-2025

Learn to Trade Options Like a Pro: Tools and Strategies for Retail Traders

Want to trade options with your savvy friend or neighbor? Discover essential tools and beginner-friendly strategies to help retail traders excel in options trading.

Jul-18-2025

The Transformation of the Investment Market by AI-Powered Options Trading Apps

Explore how AI is revolutionizing option trading strategies with smart tools and platforms. Learn how predictive analytics enhance trading performance.

Jul-16-2025

Advanced Options Trading Strategies Applied by Hedge Funds to Remain Ahead

Explore top 2025 options strategies to boost returns tailored to financial advisors and portfolio managers. Maximize returns and stay ahead in the market.

Jul-15-2025

Using Politician Investment Data to Predict Options Market Sentiment

Use politician trade data to gauge market sentiment and refine your options strategies with timely,sentiment-driven insights

Jul-09-2025

Best Options Trading Strategies in 2025

Discover the best options trading strategies for 2025 tailored to financial advisors and portfolio managers. Maximize returns, manage risk, and stay ahead in dynamic markets.

Jun-23-2025

What Unusual Options Flow Tells Us About the Next Market Move

Institutional behavior is an important aspect of individual investors in a time when volatility and algorithmic markets are at an all-time high. Monitoring unusual ...

Apr-02-2025

U.S. Industry’s Future: Tariffs, Isolation & Manufacturing

Explore how tariffs and isolationism impact U.S. manufacturing. Learn what’s at stake for American industry in this shifting economic and trade landscape.

Mar-31-2025

Understanding Window Dressing & End-of-Quarter Market Moves

Explore how institutional investors use window dressing at quarter's end to influence stock prices, and what it means for market behavior and investor strategy.

Mar-27-2025

Mastering Time in Force Orders: Essential Strategies for Smarter Trading

Learn how Time in Force (TIF) orders—like GTC, IOC, FOK, and more—can help you control trade execution, reduce slippage, and align with your trading goals. Don't just hold forever—trade smarter.

Mar-25-2025

The Importance of Time Frames in Investing: Matching the Right Horizon to Your Strategy

Investing and trading require different mindsets, tools, and time frames. Are you sprinting in a marathon? Learn the key differences between short-term trading and long-term investing—so you don’t end up panic-selling or bag-holding.

Mar-25-2025

Why Using a Price Chart for an Option is a Waste of Time (and Possibly Brain Cells)

Stop wasting time analyzing option price charts! They’re misleading, unreliable, and won’t help your trades. Learn why liquidity, implied volatility, and the underlying asset matter more—and what you should focus on instead to trade smarter

Mar-24-2025

Political Bias vs. Fundamental Analysis: The TSLA Conundrum

Is your TSLA outlook shaped by data or opinion? Learn how SensaMarket separates politics from fundamentals in smart investing.

Mar-20-2025

Utilities: The Tortoise in a Hare’s World

Learn why the utilities sector outperforms in turbulent times. Explore its role as a defensive asset for long-term, low-risk Investing.

Mar-19-2025

Beta: A Powerful Yet Overlooked Indicator

Discover why beta is a vital yet overlooked tool for risk and diversification. Learn how beta values help balance and strengthen your investment portfolio.

Mar-18-2025

Bonds, Rates & Duration: Understanding the Bond Market Relationship

Discover how bond prices, interest rates, and duration connect. See how rate shifts impact value and why duration shows sensitivity for smarter investing.

Mar-17-2025

zim-bombs-away

Discover why ZIM Integrated Shipping Services Ltd. (ZIM) has one of the lowest P/E ratios on Nasdaq. Explore its valuation, cyclical industry dynamics, debt structure, and market sentiment to determine if it’s a value stock or a value trap. Stay informed with Sensamarket

Mar-16-2025

S&P 500 Drops 10%: Correction History, Investor Moves, and Market Outlook

The S&P 500 has entered correction territory with a 10% drop. Explore historical insights, technical trends, macro risks, and actionable tips for navigating market volatility.

Mar-13-2025

Market Making Explained: Risks, Liquidity, and Realities in Financial Markets

Dive into the world of market making discover how liquidity providers manage risk, compete in liquid and illiquid assets the psychological challenges behind every quote.

Mar-11-2025

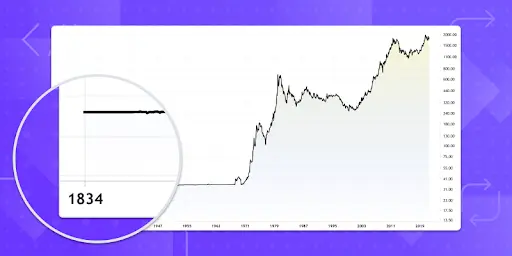

Smoot-Hawley: A Brief History

Discover the economic disaster of the Smoot-Hawley Tariff Act of 1930—a well-intentioned policy that worsened the Great Depression. Learn how tariffs triggered a global trade war, crushed exports, and led to a 90% market collapse. History warns us: trade wars don’t end well.

Mar-10-2025

Closed-End Funds (CEFs): The Mystery Box!

Closed-End Funds (CEFs) offer investors a unique way to generate income through diversified assets, leveraging, and active management. Learn how they work, their risks, benefits, and key factors to consider before investing.

Mar-07-2025

What is the VIX? Understanding Volatility Index & VIX Options Explained

Learn what the VIX (Volatility Index) measures, how it reflects market fear, and how VIX options and volatility futures work to hedge or speculate on market swings.

Mar-05-2025

Match Investment Strategy to the Right Time Frame By SensaMarket

Learn how aligning your investment strategy with short, medium, or long-term horizons can improve results and keep your goals on track.

Mar-04-2025

Tariffs, Tariffs, and Tariffs, Oh My!

Explore the impact of new tariffs on consumer staples stocks and agricultural futures markets. Learn how these sectors react to economic shifts, market volatility, and trade disruptions, with insights on trading opportunities in the current landscape.

Mar-03-2025

The S&P 500: The 5% Retracement Bounce That Just Won’t Quit

The S&P 500 continues to bounce off the 5% retracement level, proving its strength as a key support zone for institutional money. Explore the technicals behind the latest rebound, including Bollinger Bands, RSI, volume spikes, and options flow. Is this just another routine pullback, or is a bigger move ahead? Read on to find out.

Feb-26-2025

Decoding Option Flow: Reading the Tape Like a Pro

Learn how to analyze option flow like a pro. Understand call vs. put ratios, bid vs. ask blocks, sweeps, premium trades, and dark pool activity to spot market moves before they happen. Smart money isn’t always smart—follow the clues and trade responsibly.

Feb-25-2025

Gamma - Finding explosive PnL

Discover how Gamma impacts your options trading strategy. Learn how to leverage explosive PnL movements, manage risk, and use gamma to your advantage with expert insights and real-world examples. Master options trading strategies with The SensaMarket!

Feb-24-2025

Maiden Mexico

Mexico's stock market is breaking out, and FLMX is leading the charge. Learn why this rally could be the start of something bigger, the impact of global trade wars, and how to capitalize on the nearshoring trend. Read the full analysis now!

Feb-20-2025

Navigating the U.S. Interest Rate Landscape in 2025

Navigating the U.S. interest rate landscape in 2025? Stay ahead with expert insights on Fed policies, inflation trends, and market strategies. Discover how interest rate decisions impact option strategies, politician trades, institutional holdings, and option flow—only on SensaMarket.com!